|

#2

November 18th, 2017, 04:11 PM

| |||

| |||

| Re: State Bank of Hyderabad Education Loan Application Form

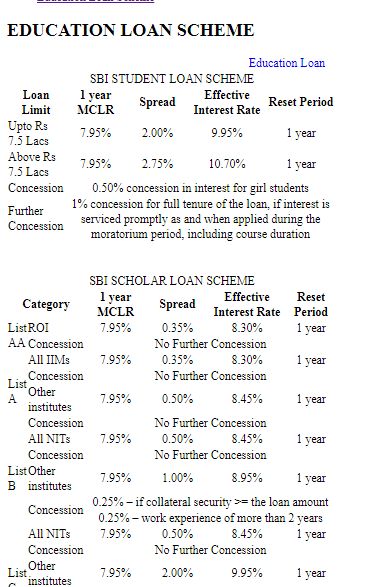

As of 1st April 2017 State Bank of Hyderabad and all the other associate banks have been merged with State Bank of India and is now recognised as one entity namely State Bank of India. So the information provided below is about State Bank of India. SBI Student Loan Scheme is a term credit allowed to Indian Nationals for seeking after advanced education in India or abroad where affirmation has been secured. Reimbursement time of upto 15 years after Course Period + a year of reimbursement holiday No preparing/forthright charges will be exacted on Education advances. Qualification A term credit allowed to Indian Nationals for seeking after advanced education in India or abroad where affirmation has been secured. Courses Covered a. Studies in India: Graduation, Post-graduation including normal specialized and expert Degree/Diploma courses directed by schools/colleges affirmed by UGC/AICTE/IMC/Govt. and so forth Normal Degree/Diploma Courses directed via self-ruling organizations like IIT, IIM and so forth Educator preparing/Nursing courses affirmed by Central government or the State Government Customary Degree/Diploma Courses like Aeronautical, pilot preparing, shipping and so on affirmed by Director General of Civil Aviation/Shipping/concerned administrative expert b. Studies Abroad: Employment situated proficient/specialized Graduation Degree courses/Post Graduation Degree and Diploma courses like MCA, MBA, MS, and so forth offered by presumed colleges Courses directed by CIMA (Chartered Institute of Management Accountants) - London, CPA (Certified Public Accountant) in USA and so forth. Costs Covered Expenses payable to school/school/inn Examination/Library/Laboratory expenses Buy of Books/Equipment/Instruments/Uniforms, Purchase of PCs basic for consummation of the course (most extreme 20% of the aggregate educational cost charges payable for finishing of the course) Alert Deposit/Building Fund/Refundable Deposit (greatest 10% of educational cost expenses for the whole course) Travel Expenses/Passage cash for examines abroad Cost of a Two-wheeler upto Rs. 50,000/ - Some other costs required to finish the course like examination visits, extend work and so on Loan Amount For examines in India - most extreme Rs. 10 lacs Concentrates abroad - most extreme Rs. 20 lacs Education Loan Scheme Rate of Interest  Documents Required: Letter of admission Completely filled in Loan Application Form 2 passport size photographs Statement of cost of study PAN Card of the student and Parent/ Guardian AADHAR Card of the student and Parent/ Guardian Proof of identity (Driving Licence/Passport/Aadhar/ any photo identity) Proof of residence (Driving Licence/Passport/Electricity bill/Telephone bill) Student/Co-borrower/ guarantor's bank account statement for last 6 months IT return/ IT assessment order, of previous 2 years of Parent/ Guardian/ other co-borrower (if IT Payee) Brief statement of assets & liabilities of Parent/ Guardian/ other co-borrower Proof of income (i.e. salary slips/ Form 16) Parent/ Guardian/ other co-borrower |