|

#1

January 13th, 2017, 03:40 PM

| |||

| |||

| Home Loan Union Bank of India

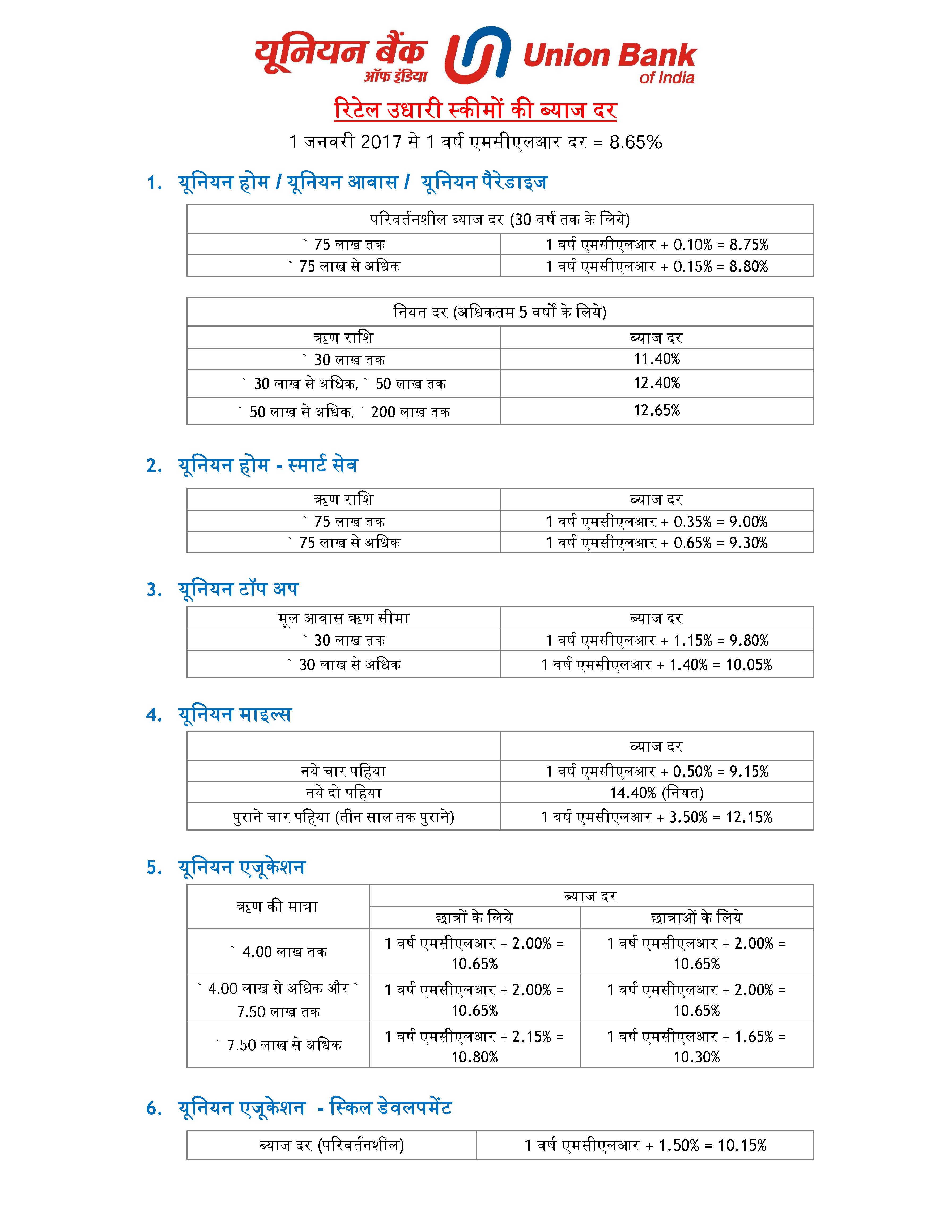

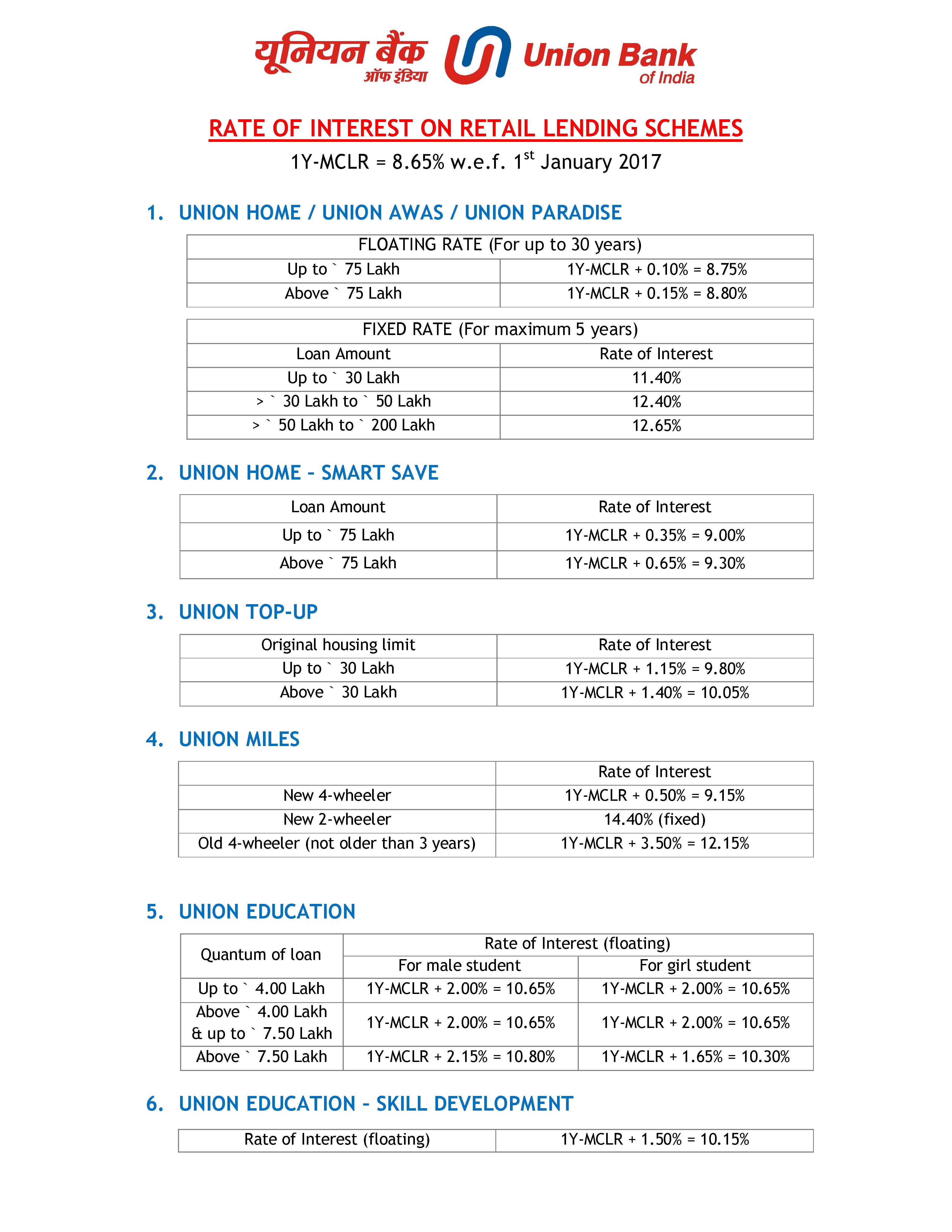

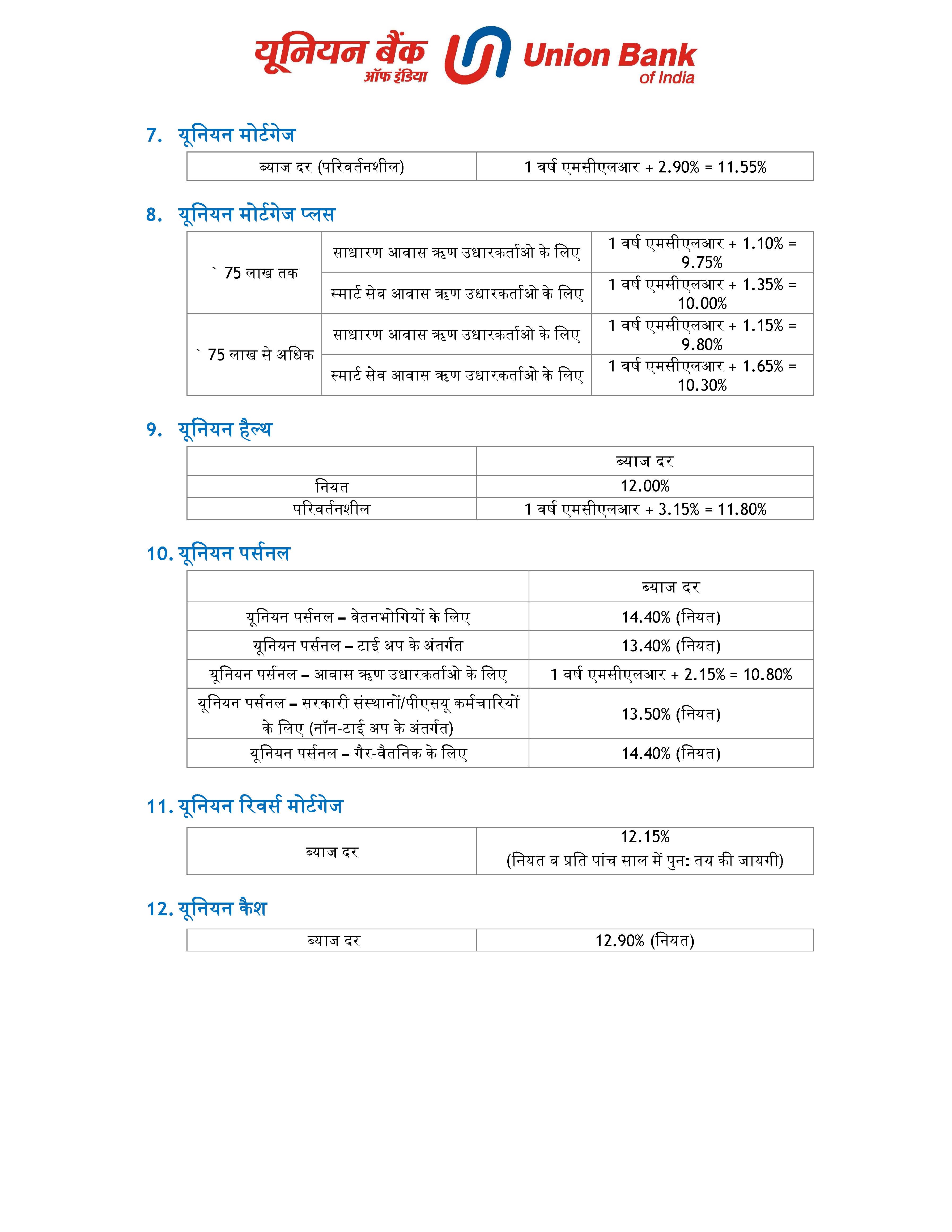

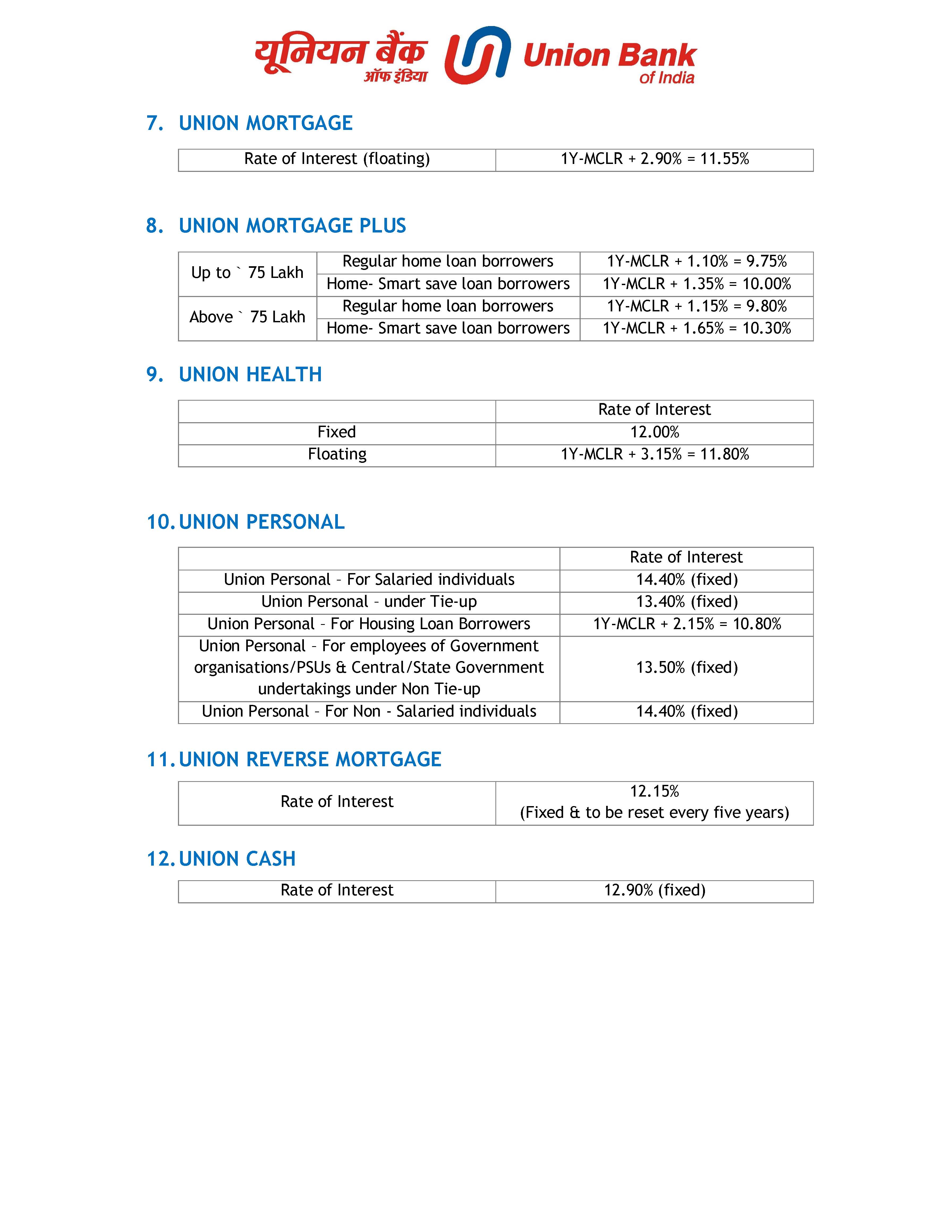

My father wants to apply for Home Loan at Union Bank of India. He wants to know about eligibility criteria to apply for Home Loan. So please tell me about eligibility criteria for Home Loan with interest rates by Union Bank of India? The Union Bank of India is one of the leading public sector banks in India. Here I am providing details about Home Loan of Union Bank of India. Union Bank of India Home Loan Details Eligibility: Minimum Age: 21 Years Nationality: Indian Citizen Individual, either singly or jointly with other family members viz. father, mother, son and/or spouse, who have regular sources of income as co-applicants. Siblings, i.e. brother-sister, brother- brother, sister-sister can be permitted as a applicants/co-applicants subject to the property must be in the joint names of the siblings. NRIs are also eligible for the home loan. QUANTUM OF LOAN Depending on repayment capacity of the borrower and value of property Maximum Rs. 30 Lakhs for Repairs. MARGIN, I.E. YOUR SHARE 20% of the total cost of the purchase/ construction of house/ flat for loans upto Rs. 75 Lakhs 25% of the total cost of the purchase/ construction of house/ flat for loans Above Rs. 75 lakhs to Rs. 2 Crores 35% of the total cost of the purchase/ construction of house/ flat for loans Above Rs. 2 Crores 20% of total cost of the repairs MORATORIUM PERIOD Moratorium period of up to 36 months. REPAYMENT Repayment period of up to 30 years 10 years in case of repairs Flexible methods of repayment RATE OF INTEREST AND PROCESSING CHARGES TENOR MCLR (%) Overnight MCLR 9.05% One month MCLR 9.10% Three month MCLR 9.15% Six month MCLR 9.25% One year MCLR 9.30% Two year MCLR 9.35% Three year MCLR 9.40% Our Base Rate w.e.f. 01/12/2016 9.55% . Our Bench Prime Lending Rate [BPLR] w.e.f. 01/03/2016 14.25% Union Bank of India Home Loan Interest Rate     PREPAYMENT PENALTY Floating rate loans There is no prepayment penalty if loan is prepaid from own verifiable sources or taken over by other banks/FIs. SECURITY Equitable mortgage (E.M.) of the residential property GUARANTEE Third party guarantee is not mandatory for Resident Indian INSURANCE Property insurance is compulsory to the tune of the value of the property Helpline: All-India Toll Free number 1800 22 22 44 1800 208 2244 Last edited by Neelurk; March 27th, 2020 at 08:59 AM. |